child tax credit payment schedule irs

Between 9 million and 10 million taxpayers remain eligible for COVID-19 stimulus payments worth thousands of dollars but the deadline is fast approaching. Advance Child Tax Credit Payments in 2021.

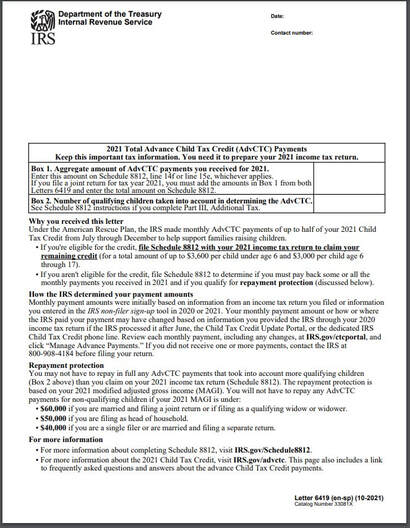

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Enhanced child tax credit.

. Dates for earlier payments are shown in the schedule below. These updated FAQs were released to the public in Fact Sheet 2022. Up to 3600 per child or up to 1800 per child if you.

Child Tax Credit Payment Schedule 2022 Chigasakiribbon from. The amount of credit you receive is based on your income and the. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E.

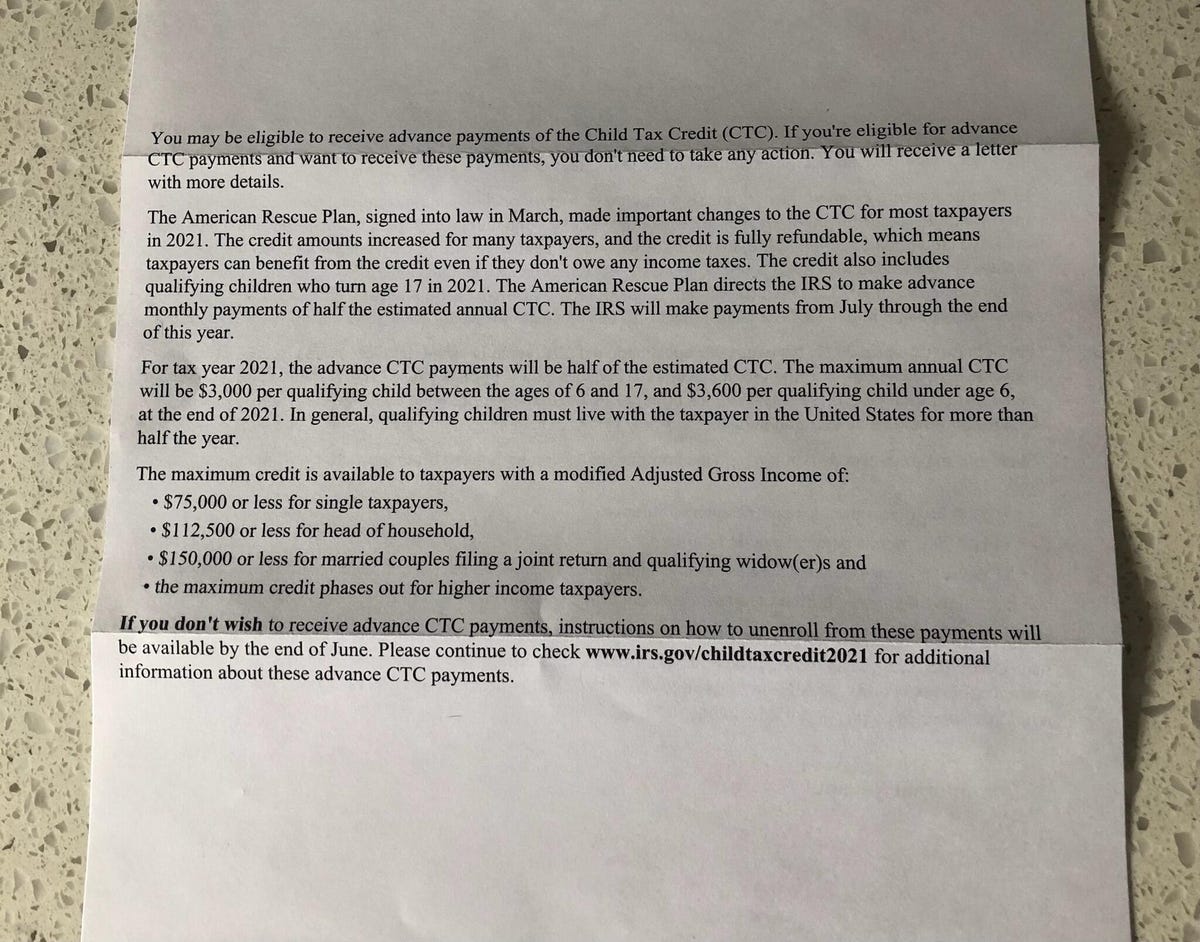

The deadline for applications was July 22 and now city officials expect payments to be sent out in August or September. The rollout of funds for the expanded child tax credit is expected to start July 15 and the IRS has already started sending out letters to 36 million families it believes are eligible. The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to. WASHINGTON The Internal Revenue Service today updated its frequently asked questions FAQs FS-2022-17 PDF on the 2021 Child Tax Credit.

The payments will be paid via direct deposit or check. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. The expansion increased the.

Mark These Dates on Your Calendar Now. How much money you could be getting from child tax credit and stimulus payments. From then the schedule of payments will be as follows.

IR-2022-53 March 8 2022. Here are the dates the Child Tax Credit Payments should show up in your accounts. American families who qualify for the enhanced Child Tax Credit still have a couple more weeks to sign up for it.

The IRS will use 2020 tax information to calculate the credit unless it has yet to be filed or processed in which case 2019 data will be used. As part of the American Rescue Act signed into law by President Joe Biden in March of. One of the compromises in the.

How much money you could be getting from child tax credit and stimulus payments. Each payment will be up to 300 for each qualifying child under the. For eligible parents who filed tax returns for 2020 or 2019 and have a declared dependent the IRS will automatically send you an advance monthly payment for your 2021.

November 15 2021 242 PM CBS Los Angeles. Up to 3600 per child or up to 1800 per child if you. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child.

The monthly payments are part of the expansion of the Child Tax Credit that was approved when the American Rescue Plan was passed in March. Additionally households in Connecticut can claim up to. Enhanced child tax credit.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. The refundable portions of the Earned Income Tax Credit and Child Tax Credit help low- and moderate-income working families by offering cash payments to eligible individuals. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax.

The new advance Child Tax Credit is based on your previously filed.

Advance Child Tax Credit Filing Confusion Cleared Up

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

Will You Have To Repay The Advanced Child Tax Credit Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Adv Child Tax Credit Cwa Tax Professionals

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

Child Tax Credit Updates What Time What If Amount Is Wrong

Clearing Up Confusion Surrounding Changes To Child Tax Credit

When Do We Get The Child Tax Credit 2021 Payment Schedule In Full

Irs Urges Parents To Watch For New Form As Tax Season Begins